Ever wondered how long it will take for your investments to double? The Rule of 72 is a simple yet powerful tool that can help you understand how your money can grow over time. Let’s explore this concept and see how it applies to different investment options like Lumpsum Investment in equity Mutual funds, Post Office Savings, and fixed deposits.

What is the Rule of 72?

By dividing 72 by your investment’s annual rate of return, you can estimate the number of years it will take for your investment to double.

Formula:

72÷ Annual Rate of Interest/ Return = Years to Double

For example, with an 8% Annual rate of Interest /return,

your investment will double in:

72/8 = 9 years.

You can also calculate the annual rate of interest using the reverse method:

72 ÷ Number of Years for Money to Double = Annual Rate of Interest

For example, if your investment doubles in 9 years:

72 ÷ 9 =8%

So, your annual rate of interest / Return is 8%.

All these interest calculations are based on compound interest.

Why the Rule of 72 is Powerful

It helps you compare different investments and see which one might grow faster. It’s also useful for retirement planning, giving you a clear picture of how your Savings or Investments can increase over time.

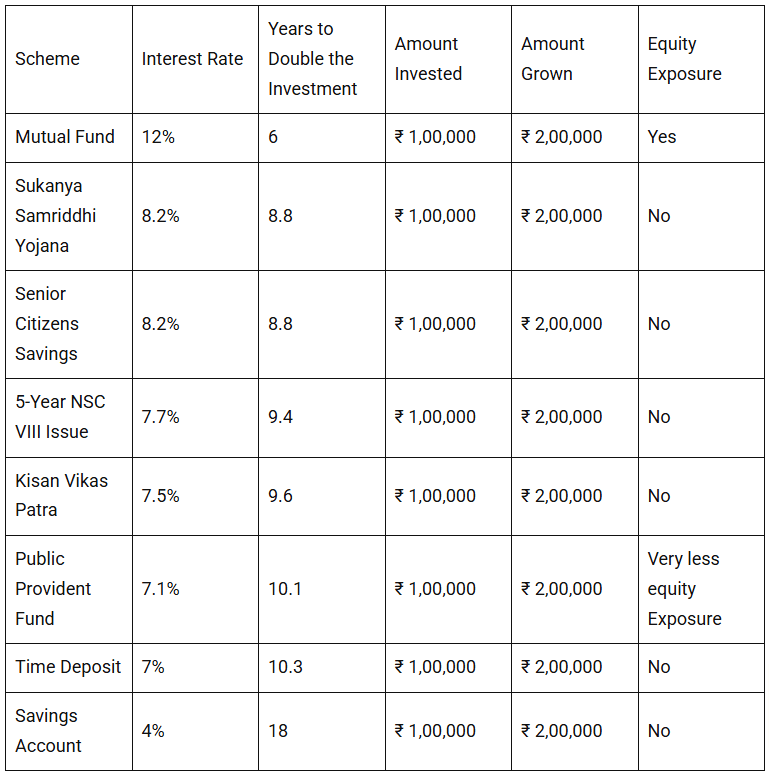

Comparing Investment Options: Lumpsum Investment in equity funds, Post Office Savings, and Fixed Deposits

Investing wisely is crucial for financial growth and security. With numerous options available, it can be challenging to decide where to put your money. This article compares popular investment options: Mutual Funds, Post Office Savings, and Fixed Deposits, using the Rule of 72 to estimate how long it will take for your investments to double.

1. Lumpsum Investment in equity funds

Lump sum investments are a type of mutual fund investment where you invest a large amount of money at once or make additional purchases. To benefit from the power of compounding over the long term, consider investing in equity mutual funds. Historically, equity mutual funds have provided an average annual return of over 12%. You can start with a minimum investment of Rs 5000.

Using the Rule of 72 to calculate the years required for investments to double:

72/12=6 years

So, if you invest a lumpsum in mutual fund equity fund with an average return of 12%, your investment could double in approximately 6 years.

2. Post office Savings

Post Office savings schemes are government-backed financial products offered by India Post.

Approximate rate of return: 7% to 8%

For calculation purposes, an 8% rate is considered.

Using the Rule of 72 to calculate the years required for investments to double:

72/8=9 years

Thus, investing in Post office Savings could potentially double your investment in around 9 years.

3. Fixed Deposits

Fixed deposits (FDs) are considered one of the safest investment options, offering guaranteed returns. However, the returns are generally lower compared to other investment avenues. Currently, fixed deposits (FDs) offer an average annual return of approximately 6% to 8%. For calculation purposes, 7% rate is considered.

Using the Rule of 72 to calculate the years required for investments to double:

72/7=10.2 years

Therefore, an investment in a fixed deposit could take approximately 10.2 years to double.

Summary of Comparison:

The interest rates for all the savings instruments mentioned above are based on the last quarter and may vary slightly over time. Mutual funds, particularly equity exposure funds, have historically provided around 12% returns, though they come with a slight risk. Past returns are not guaranteed, but holding investments for more than five years or longer increases the likelihood of better, inflation-beating returns.

Building Your Financial Future

It’s never too early to start planning for retirement. The Rule of 72 can guide you in creating a solid investment strategy. By calculating how much you need to save and how long it will take for your investments to double, you can make informed decisions about your financial future.

Although there is no proven record of its effectiveness, we can apply it to investments to easily understand the calculation when the money has doubled.

Conclusion

The Rule of 72 is a simple yet powerful tool that can help you take control of your finances. Whether you’re comparing investment options or planning for retirement, this rule provides valuable insights into how your money can grow. So, take a moment to understand and apply the Rule of 72, and set yourself on the path to financial success.

Lumpsum Investment in equity funds generally provide the fastest doubling time due to their higher return potential, followed by savings investments like Post Office Savings, fixed deposits taking the longest due to their lower return rates.

Mutual funds carry a slight risk compared to traditional savings, but they also offer better returnWith their equity exposure,mutualfundinvestments are diversified across company shares, reducing the overall risk. It’s advisable to invest for a minimum of five years; recent records show that returns improve and risk decreases over this period. While inflation at 7% nullifies savings with the same return, mutual funds yielding 12% to 15% can be quite profitable.

Unlock the power of the Rule of 72 and stay ahead in your financial journey!